7 Weekend Projects to Boost Your Property Value

Whether you’re putting your home on the market in a few weeks or a few years, strategic upgrades can make all the difference. But you don’t have to embark on a major remodel to make a significant improvement.

Even minor updates can have a big impact on your home’s aesthetic, and certain renovations can even boost its future sale price.

From curb appeal to interior updates, here are seven weekend projects that will enhance your home’s current charm and long-term value.

- Freshen Your Front Door

Is your front door looking a little tired? A new coat of paint can make your home more inviting to today’s guests and tomorrow’s buyers.

But before you grab that paintbrush, think carefully about your choice of hue. According to a recent study, the color of your front door can boost—or lower—your home’s sale price by thousands of dollars.1

Cement gray, for instance, was found to decrease purchase offers by an average of $3,365. Going too bold can also deter home shoppers. The safest bets? Classic black or a mid-tone brown are proven winners.1

Need help choosing the perfect paint or stain for your front door? We’d be happy to offer advice or refer you to a design professional for assistance.

- Upgrade Your Hardware and Lighting

It’s easy to overlook dated cabinet pulls or dingy light switches in your own home. But those seemingly minor details can leave a bad impression on visitors.

Swapping out old hardware for modern alternatives can easily and affordably elevate your space. New cabinet handles, for example, are relatively inexpensive and require just a few minutes and a screwdriver to install. To maximize the longevity of your update, consider classic shapes and finishes like brass knobs or nickel cup pulls.2

Take a look at your light fixtures, too. Try replacing an out-of-style chandelier with a more contemporary option. Even just updating your lampshades and lightbulbs can create a brighter, more welcoming space. Additionally, many experts agree that high-quality lighting can show off your property’s best features when it comes time to sell.3

Uncomfortable changing a light fixture yourself? Contact us for a referral to a licensed electrician for help.

- Update Your Bathroom Fixtures

Bathrooms can show their age quickly, but a few inexpensive updates can take years off in just a few hours. And since many buyers will be more drawn to a home that feels clean and modern, even small changes can make a big difference.

According to one study, for every dollar you spend on minor cosmetic upgrades—like swapping out the bathroom mirror, upgrading hardware, or refinishing cabinets—you’ll see a $1.71 increase in your home’s value.4

Bathroom hardware is a great place to start. Consider updating your faucets and showerheads (we recommend lower-flow options to save money and the environment), and don’t forget about towel racks, toilet paper holders, and any other fixtures that look worn or discolored.5

If you want to stay on-trend, the most popular faucet finishes are currently black, nickel, and pewter. Spa-like upgrades, like steam showers and rain showers, are also in high demand.5,6

If your existing vanity is in poor condition, installing a new one is a slightly bigger project, but it has a huge impact on the look and feel of the room. Reach out for a list of retailers who carry high-quality but affordable prefabricated options.

- Give Your Kitchen Cabinets a Makeover

The kitchen is often referred to as the heart of the home, so it’s no surprise that an updated kitchen is a top priority for current homeowners and potential buyers alike.7,8 If your kitchen cabinets are from another era, that’s probably the first place you’ll want to start.

Fortunately, you don’t need to commit to the hassle and expense of installing new cabinets if your current ones are in good shape. Instead, consider painting them.

Not only is it more affordable and eco-friendly than replacement, but Better Homes and Gardens reports that this option typically offers a greater return on investment.9 When it comes to choosing the right color, warm neutrals and shades of green and blue are especially on-trend.10

Thinking about painting your cabinets yourself? Be sure to plan in advance and block out at least a couple of days for the project. You’ll need to take off all your cabinet doors and hardware and thoroughly cover your kitchen appliances and counters. You’ll also need to wait for the doors to dry before reassembling your kitchen.11

If you’re not confident in your painting skills, hiring a professional will still be far less expensive than installing new cabinets. We’re happy to refer you to capable painters in our network.

- Look at Your Landscaping

First impressions matter, and putting some work into your home’s exterior can make a big difference in how your guests and neighbors view it. Curb appeal can also make or break a potential buyer’s perception of your home—and significantly impact their offer.

According to HomeLight, buyers will pay 7% more, on average, for a home with good curb appeal. And in some areas, the return on investment for improvements can exceed 300%.12

One of the best ways to improve curb appeal is through landscaping—and it doesn’t have to be elaborate. First and foremost, focus on keeping things neat, tidy, and welcoming. Mow your lawn, refresh any mulch, prune overgrown shrubs, and add pops of color with flowers. To take things up a notch, add outdoor lighting and plant perennial flowers along the sides of your walkway.

When you’re ready to get started, reach out for a list of our favorite local garden centers where you can find all the necessary supplies.

- Refinish Your Wood Floors

For many buyers, wood floors are a huge selling point. Unfortunately, they also tend to get scuffed and worn over time, especially if you have kids or pets.

The good news? If your wood floors could use a touch-up, it’s well worth the time and cost. According to the National Association of Realtors, it’s the project that pays off the most in terms of resale value, with an average 147% return on investment.13

If you have a few days to devote to your floors, you can rent the necessary equipment from a local hardware store. While you’re there, pick up some basic supplies, like a putty knife, paintbrushes, sandpaper, and stain.14 And if you want to modernize your space, opt for a lighter wood tone, which is the current trend.15

Of course, we’re also happy to provide the names of trusted professionals who can tackle the work for you.

- Clean or Replace Your Grout

Let’s face it: Whether it’s on a kitchen floor or a bathroom wall, grout gets grimy over time, even with regular cleaning. Fortunately, refreshing your grout is a relatively simple and affordable project that can yield impressive results.

According to Apartment Therapy, grout that’s in poor condition is often one of the first things a potential buyer notices when they tour a bathroom.16 Fresh, clean grout, on the other hand, makes your bathroom sparkle—and that can pay off in a big way in terms of buyer’s perceptions.

If your grout is simply stained, a focused cleaning session can make a big difference. Try a specialized product or a simple mix of baking soda, water, and hydrogen peroxide.16 If the grout is cracked, crumbling, or stained beyond repair, it’s time to replace it. Luckily, the right tools make that a very doable DIY project, even if it can get messy—and it’s a lot easier and less expensive than retiling.17

No time to tackle it yourself? Reach out for a recommendation of a pro who can help.

CHOOSING THE PROJECT THAT’S RIGHT FOR YOU

Embarking on home improvements can be exciting, but it’s essential to choose projects that align with your goals, budget, and skill level. Whether you’re preparing to sell your home or simply want to enhance its value, there are projects to suit every homeowner.

If you’re unsure where to start, don’t hesitate to reach out for personalized advice and recommendations. With the right approach, you can unlock your home’s full potential and enjoy the rewards for years to come.

The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs.

Sources:

- Zillow –

https://www.zillow.com/learn/what-color-paint-front-door/

- Martha Stewart –

https://www.marthastewart.com/kitchen-hardware-trends-8563764

- The Spruce –

https://www.thespruce.com/expert-home-lighting-tips-8302722

- Zillow –

https://www.zillow.com/learn/roi-for-bathroom-remodel/

- Forbes –

https://www.forbes.com/home-improvement/bathroom/easy-quick-bathroom-updates/

- Real Simple –

https://www.realsimple.com/nkba-bathroom-design-trends-2024-8403788

- Houzz –

https://www.houzz.com/magazine/2024-u-s-houzz-and-home-study-renovation-trends-stsetivw-vs~174492310

- National Association of Realtors –

https://www.nar.realtor/magazine/real-estate-news/survey-buyers-judge-a-home-by-its-kitchen

- Better Homes and Gardens –

https://www.bhg.com/kitchen/remodeling/planning/kitchen-upgrades-cost-value/

- House Beautiful –

https://www.housebeautiful.com/room-decorating/colors/g46105350/kitchen-paint-color-trends-2024/

- HGTV –

https://www.hgtv.com/design/rooms/kitchens/best-way-to-paint-kitchen-cabinets

- Homelight –

https://www.homelight.com/blog/what-upgrades-increase-home-value/

- National Association of Realtors –

https://www.nar.realtor/magazine/real-estate-news/stub-for-148394

- Architectural Digest –

https://www.architecturaldigest.com/story/refinishing-hardwood-floors

- Houzz –

https://www.houzz.com/magazine/5-new-trends-in-flooring-for-2024-stsetivw-vs~173560747

- Apartment Therapy –

https://www.apartmenttherapy.com/outdated-bathroom-features-37131219

- Better Homes and Gardens –

https://www.bhg.com/how-to-regrout-tile-7554710

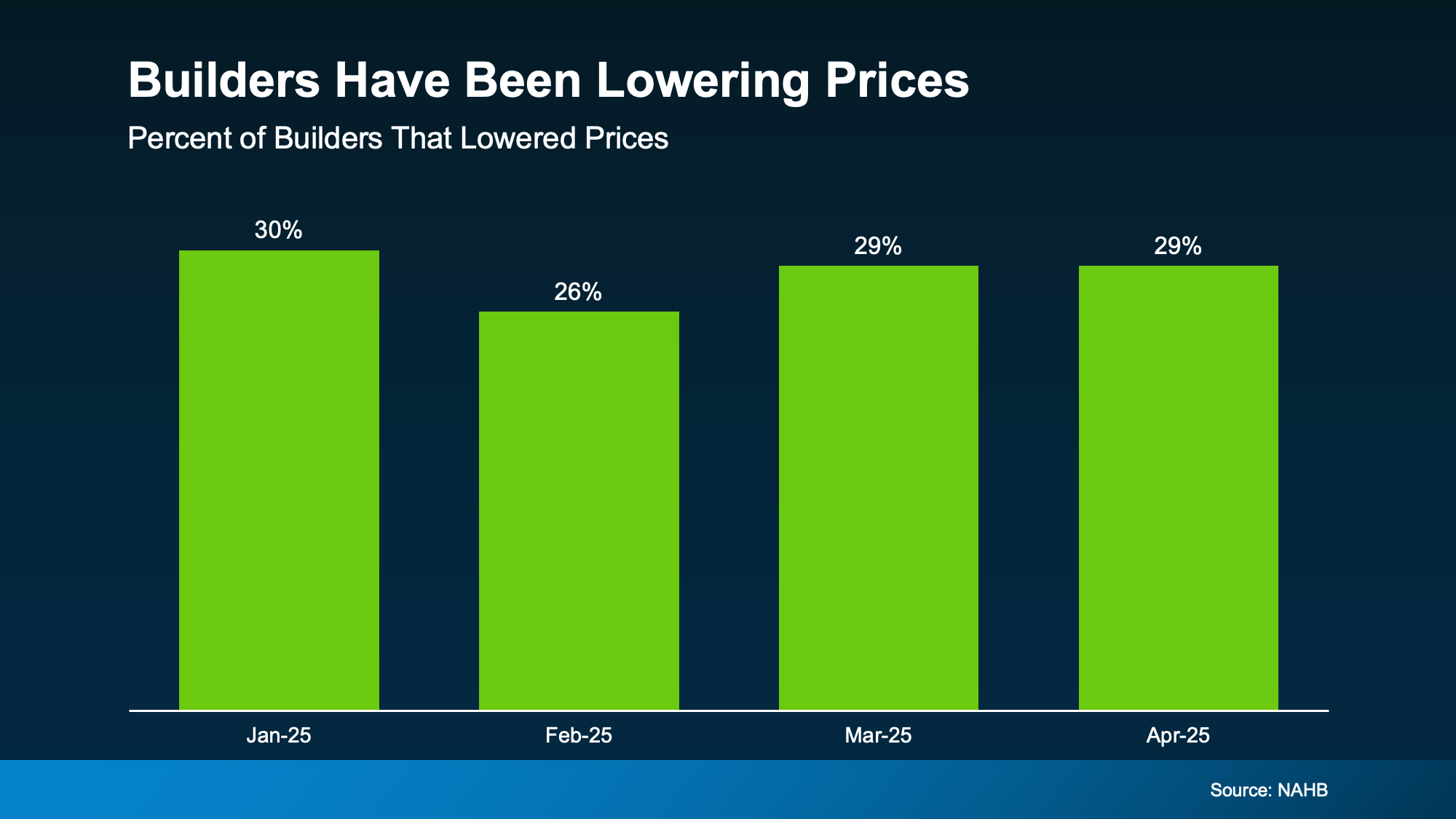

Around 30% of builders lowered prices in each of the first four months of the year. While that also means most builders aren’t lowering prices, it also shows some are willing to negotiate with buyers to get a deal done.

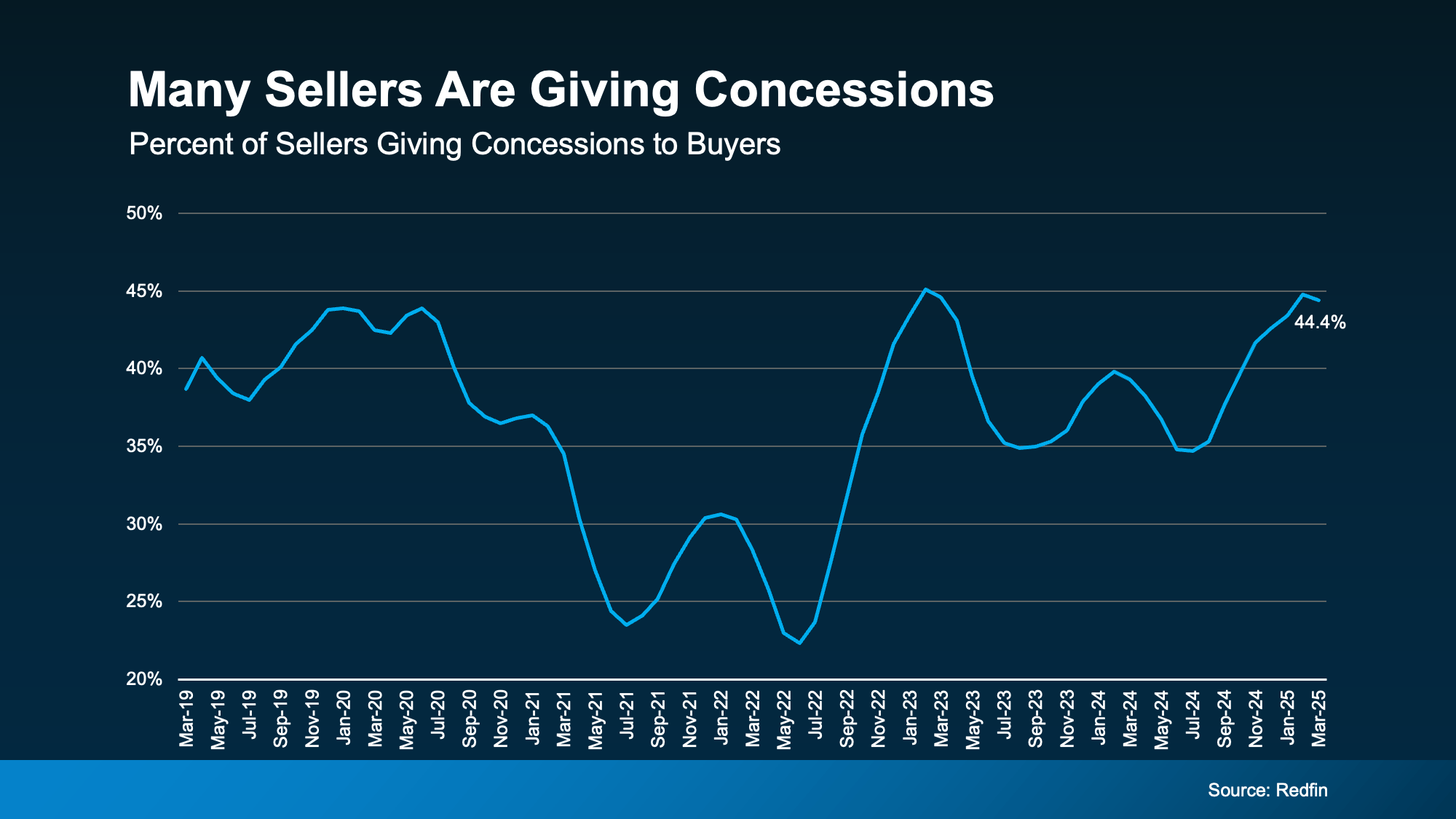

Around 30% of builders lowered prices in each of the first four months of the year. While that also means most builders aren’t lowering prices, it also shows some are willing to negotiate with buyers to get a deal done. And, if you look back at pre-pandemic years on this graph, you’ll see 44% is pretty much returning to normal. After years of sellers having all the power, the market is balancing again, which can work in your favor as a buyer.

And, if you look back at pre-pandemic years on this graph, you’ll see 44% is pretty much returning to normal. After years of sellers having all the power, the market is balancing again, which can work in your favor as a buyer.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

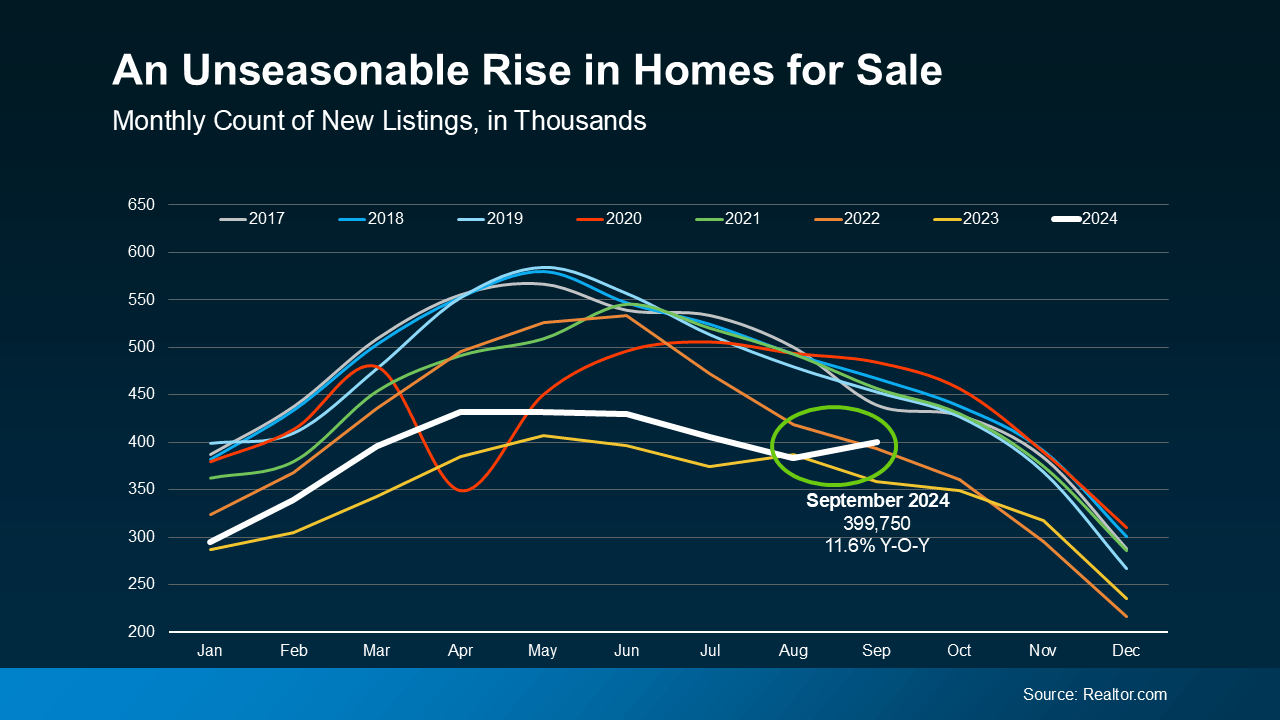

For anyone who’s been waiting for more choices, this is exactly what you’ve been hoping for – because more homes coming onto the market means more options and a better shot at finding one that fits your needs.

For anyone who’s been waiting for more choices, this is exactly what you’ve been hoping for – because more homes coming onto the market means more options and a better shot at finding one that fits your needs.

What This Means for You

What This Means for You